Introducing Drawdown

In Forex, adept risk monitoring and management are pivotal for ensuring sustained profitability. A fundamental metric traders employ for evaluating risk is the drawdown, which signifies the decline from a peak to a trough for an investment or trading account over a designated period.

Drawdowns are indicators of the reduction in account value, typically represented as a percentage. Grasping the extent and duration of drawdowns is essential for traders and investors as it aids in gauging the risk and the prospect of recovery.

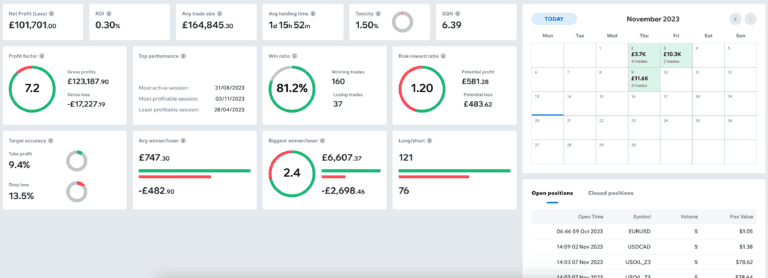

In light of its importance, our software Tradelytic has newly incorporated drawdown reports within the reports section of the website, offering a meticulous analysis of drawdown metrics. This addition empowers traders with crucial insights, assisting in thoroughly evaluating trading strategies and investment decisions.

The Importance of Monitoring Drawdown:

Risk Assessment:

Drawdowns provide a real-world evaluation of the risk associated with a particular trading strategy or investment. A high drawdown often signals high risk, and vice versa.

Performance Evaluation:

By analyzing drawdowns, traders can compare the risk-reward profiles of different strategies or investments. It also helps in understanding a strategy’s historical performance and resilience during adverse market conditions.

Capital Preservation:

Monitoring drawdowns is crucial for capital preservation. It helps identify when a strategy is veering off course, allowing traders to make informed decisions to protect their capital.

Investor Confidence:

Transparency in reporting drawdowns can build investor confidence by showing a realistic picture of risk and performance, essential for trust and long-term relationship building.

Tradelytic: Your Companion for Effective Drawdown Management:

Tradelytic is a cutting-edge trading analysis software designed to empower traders with precise and actionable insights. Among its myriad features, it provides comprehensive reports on drawdown metrics, making it an indispensable tool for modern traders.

Average Drawdown:

Tradelytic computes the average drawdown, giving traders a sense of the typical decline they might expect.

Biggest Drawdown:

Knowing the biggest drawdown helps you understand and prepare for the worst-case scenario.

Average Number Of Trades In Drawdown:

This metric provides insight into the average number of trades occurring during a drawdown, helping traders understand their strategies’ behaviour during downturns.

Average Number of Days In Drawdown:

It’s essential to know how long, on average, an account stays in a drawdown. This helps in assessing the trading strategy’s resilience and recovery potential.

Number of Days In Drawdown:

Tradelytic provides the total number of days in drawdown, allowing for a broader perspective on the strategy’s performance over time.

Tradelytic comprehensive drawdown analysis helps traders and investors monitor and manage risks and refine their strategies for better performance. The software’s intuitive interface and robust analytics make dissecting and understanding drawdowns easier, making it a valuable addition to any trader’s toolkit. With Tradelytic, navigating through the tumultuous waters of trading becomes a data-driven and insightful endeavour, promoting better decision-making and, ultimately, better trading outcomes, and we’re just getting started!